Low And Slow: The Secret To BBQ, Crock Pots, and Investing

We’re all sitting inside our houses these days, waiting for the signal that we can move on from aggressive quarantine measures. Folks have no choice but to be patient as we all give scientists, medical professionals, and public health officials time to figure out what the heck is going on. The time at home has probably breathed new life into old hobbies, given you time to explore new ones, and if it hasn’t, that’s perfectly understandable too. Just getting through each day can be a lot right now. But for me, one of the best things I’ve done was get my smoker all cleaned up. I loooooooooooooove a good excuse to dote on the smoker out back over the course of a nice day. Maybe with a beer. Maybe not. I smoked a pork shoulder last week and just having an excuse to walk outside every hour or so over the course of 12 hours to add wood chips was great for me.

The secret to good BBQ often lies in turning tough cuts of meat into something incredible over a lot of time. Raw cuts of brisket, for example, could probably be used in bulletproof vests or to patch potholes. It’s a tough cut of beef that needs a lot of time at low temperatures to break down into something edible. I smoke most things at approximately 225 degrees for the better part of a day. So, very low and slow, and certainly not something that can be thrown together. I usually prepare whatever I’m smoking the night before, sometimes two nights before.

Which is an interesting parallel to investing. There’s nothing terribly exciting about putting $100 in an IRA every month. Or $400 a paycheck into a 401(k) for 30 years from now. It’s boring, and you probably could easily come up with hundreds of things to do with that money that would be immediately fulfilling. But just like BBQ, good things happen with a lot of preparation and patience over time.

The Buffett Buffet Of Wisdom

My friend Eric gets the assist for the idea for this blog. He shared a fantastic blog post with me with an evolving-story about Warren Buffett’s wealth and some important context about when he acquired most of it. Mr. Buffett is a fantastic investor, but perhaps above everything else, he is a patient investor. There are all kinds of stories about how much he was investing from his paper route at certain ages, but the thing that blew me away was the age he acquired most of his wealth. Give or take the swings in the market, Mr. Buffett is a rich man. He’s 89 and has amassed somewhere north of $67 billion dollars over a long and illustrious investing career, making him perennially one of the richest people in the world.

And perhaps the most staggering part of Mr. Buffett’s wealth is when he acquired most of it. Over 99% of his wealth was acquired AFTER he turned 50. Which means, if you’re reading this, there’s still time for you! I’m focusing on this because it points to the most significant and powerful concept in investing: compound interest.

When I teach my Temple students about compound interest, we talk about the returns in percentages first. They’re mostly college freshmen, so $100 might as well be $1,000,000 (I’m convinced college students are actually phenomenal with money, they can make $20 last 3 weeks). So we walk through how much they’ll have after a positive 10% return ($110). So what happens if they make another 10%? Well, now their earnings are earning that positive return as well. We’re growing $110 by 10% instead of just $100. So, the 10% makes us more money this time around. A 10% return on $100,000 in your IRA is not going to yield the same growth as a 10% return on Mr. Buffett’s $67 billion. Although the percentages are the same, the dollars are not.

Therein lies the secret to Mr. Buffett’s success, or at least one of them. Time. Mr. Buffett has been investing for over 75 years. All of his little contributions from his paper route, so to speak, have had a chance to blossom into something much bigger, with patience and skill. The early contributions, given enough time to bake (or smoke!), are enormous today because of the magic of compound interest. The article that my friend Eric shared with me posits that approximately 97% of Mr. Buffett’s net worth can be directly attributed to the wealth he had before he was 30. So, the investments he made as a kid during World War II laid the foundation for what he has now. Despite the uncertainty the world was facing back then, he invested what he had, and better times rewarded him for putting money to work despite the anxiety the country was feeling. Sound familiar?

Do You Believe In Magic?

Not the catchy song by The Lovin’ Spoonful (you’re singing it to yourself right now, aren’t you? Maybe a little?) The magic of compound interest. If your bills are paid and you’re not in danger of losing the house, this is a great time to renew your faith in the power of compound interest. Let’s use an example to illustrate how time is on your side.

Suppose you, being you, are incredibly brilliant, charming, attractive (obviously!), museums call you to value paintings, you haven’t missed a North American Stones tour ever, you built your own house, the list goes on.

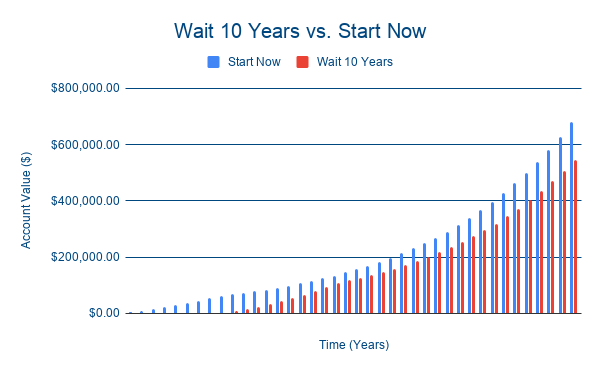

You start investing at age 25. Just $5,000/year for 10 years. $50,000 total. Then you stop contributing. No more. Zip. Nada. You just kick your feet up and coast. If you let your initial contributions compound, even after you stopped contributing, until you were 65, you’d end up with $678,553.

Your equally affable but less savvy friend waits until age 35 to get started. It’s only 10 years, right? Trying to catch up to you, they invest $7,500/year for 10 years. $75,000 total, or $25,000 more than you invested. Despite contributing 50% more money than you did, they only end up with $546,922.

They never catch up. Compound interest favors time invested in the market over delayed, larger contributions.

Moral of the story: early contributions are incredibly valuable later, even if they’re modest now. That’s why I get all teary-eyed when people write off the power of increasing their 401(k) contribution by “just 1%” or increasing their 529 plan contributions by “only $50.” The increased contributions are great, but they’re really the platform for future growth when the market turns around.

Inch By Inch, It’s A Cinch

There’s an old saying that goes something like “by the mile, it’s a trial. By the yard it’s hard. But inch by inch, it’s a cinch.” And that’s relevant in investing too. By now, you can probably tell I’m a fan of investing over time.

But that’s not the end of my enthusiasm for “low and slow.” Instead of waiting until some magical “right time” to increase your investment contributions, I’m a big fan of increasing it annually as you get raises (without overburdening your cash flow, of course).

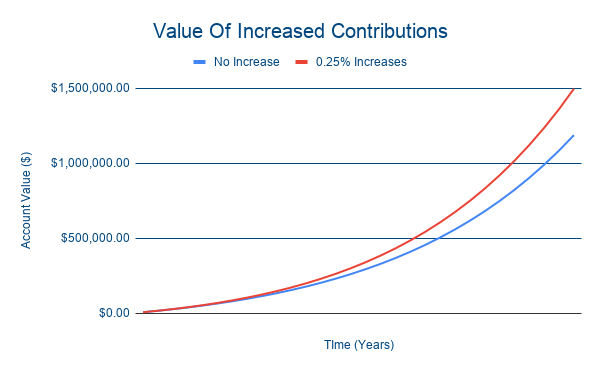

Suppose you earned an $80,000 salary and you contributed 10% of your salary into your 401(k), earning 8% a year on a hypothetical investment. Also suppose you got a 2% raise every year.

After 30 years, you’d have $1,188,186.52. Sweet, right? Just by virtue of keeping your contribution rate steady as you’re getting raises, you save more and more every year.

But what if you took a little bit more of a strategic approach? Say, you increased your 401(k) contribution by another 0.25% of your salary per year. Same hypotheticals. $80,000/year salary to start, 2% raise/year, 8% annual return on a hypothetical investment, and start your 401(k) contribution at 10% and increasing it by 0.25% annually. How much could just an extra 0.25% more per year really yield?

After 30 years, you’d have $1,497,538.74, or $309,352 more than not increasing your contributions. Not bad for bumping up your contribution by “just” another 0.25% a year! This is one of the biggest selling points of working with a financial planner (me!). You’re busy. Having someone help you remember to “increase my 401(k) contributions” on an annual basis is a small nudge that can have big results.

Perhaps best of all, is that the increases were spread out over time. You’re unlikely to really miss 0.25% of your salary. But inch by inch, year by year, low and slow…you get the picture! It adds up to big dollars.

If your income is stable, let’s talk about what you can do to take advantage of the market, in addition to the evergreen financial planning opportunities in front of you. Book a complimentary discussion on my website today.

Stay safe out there!

-Brendan