CARES Act Planning

The government stimulus package or the CARES Act that was signed into law last week was almost nine hundred pages. This humble tome was only 10 pages in Google docs, so I’ve done my best to condense what’s relevant to you and present some planning opportunities. I’m confident even people under rocks are aware of the unprecedented interruption to our daily lives and the very real health risks posed to humans by COVID-19 that are manifesting into economic risks too. As a result, the U.S. put together the 2+ trillion dollar Coronavirus Aid, Relief, and Economic Security (CARES) Act of 2020 to stimulate the economy and provide economic relief to those in need.

My goal for this blog post is to help you understand how the CARES Act might apply to you or folks you care about. Many of the provisions are still opaque with reference to future guidance from a number of authorities, including the IRS, Secretary of Treasury, etc. So check back here often for updates as I’ve done my best to boil down the planning opportunities into English. That said, this is largely a tax-related piece of legislation, and there are a lot of breadcrumbs to follow as the logistics of these programs unfold. The whole thing involves a lot of exceptions, “up to,” “unless,” so it is best to talk to a professional about how this applies to your situation.

Straight Cash, Homie

One of the biggest focuses of the CARES Act was how to get money to people quickly. About $500 billion dollars worth will be sent to recipients to help keep them afloat. The CARES Act does this via a tax credit against 2020 income and sending people, as my friend Randy Moss would say, straight cash, homie. The checks are not taxable. Here’s how the payments break down.

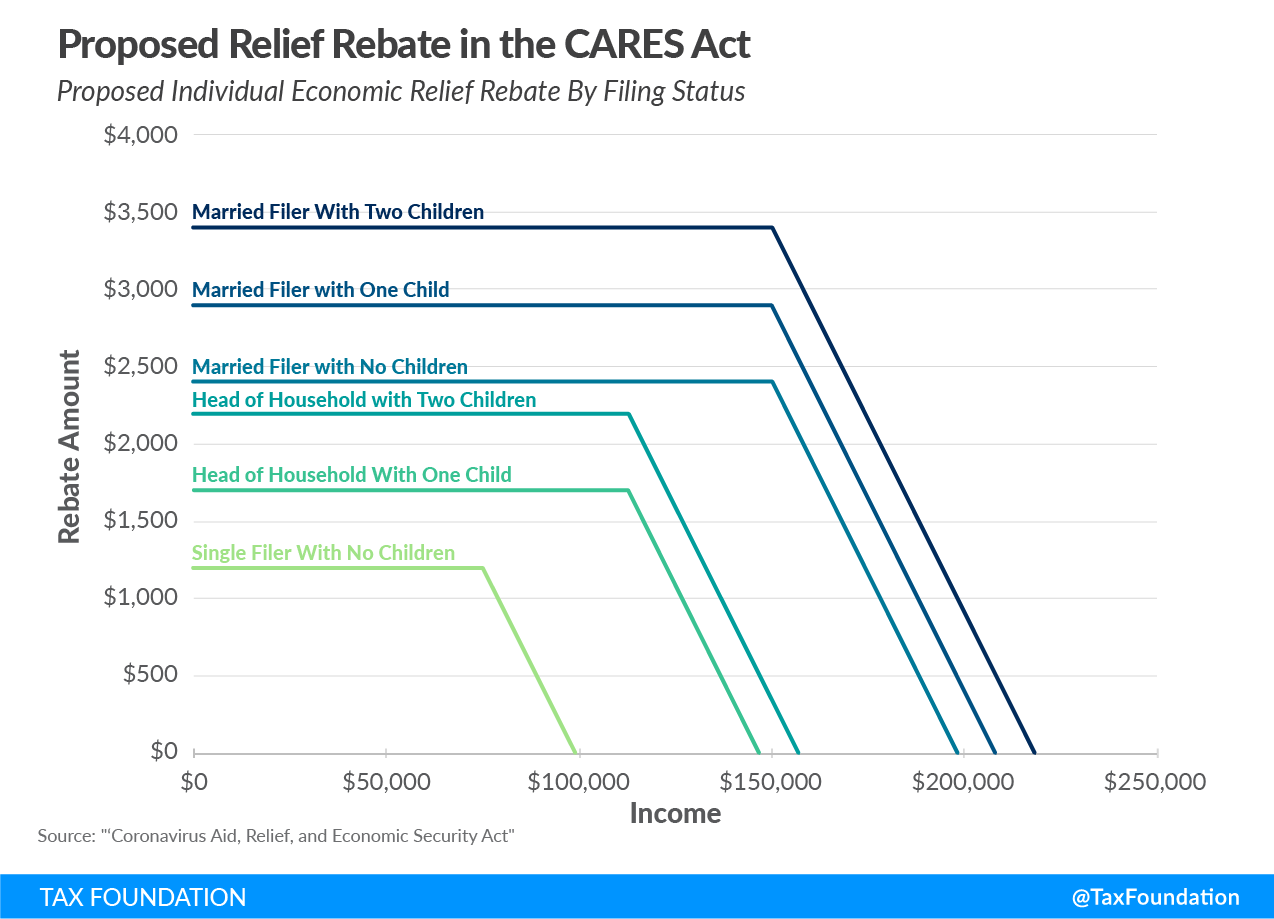

$1,200 will be distributed to individuals that made less than $75,000 of Adjusted Gross Income (AGI) for 2018 or 2019.

$2,400 will be distributed to couples filing jointly that made less than $150,000 (AGI) for 2018 or 2019.

$1,200 will be distributed to persons filing as head of household that made less than $112,500 in 2018 or 2019.

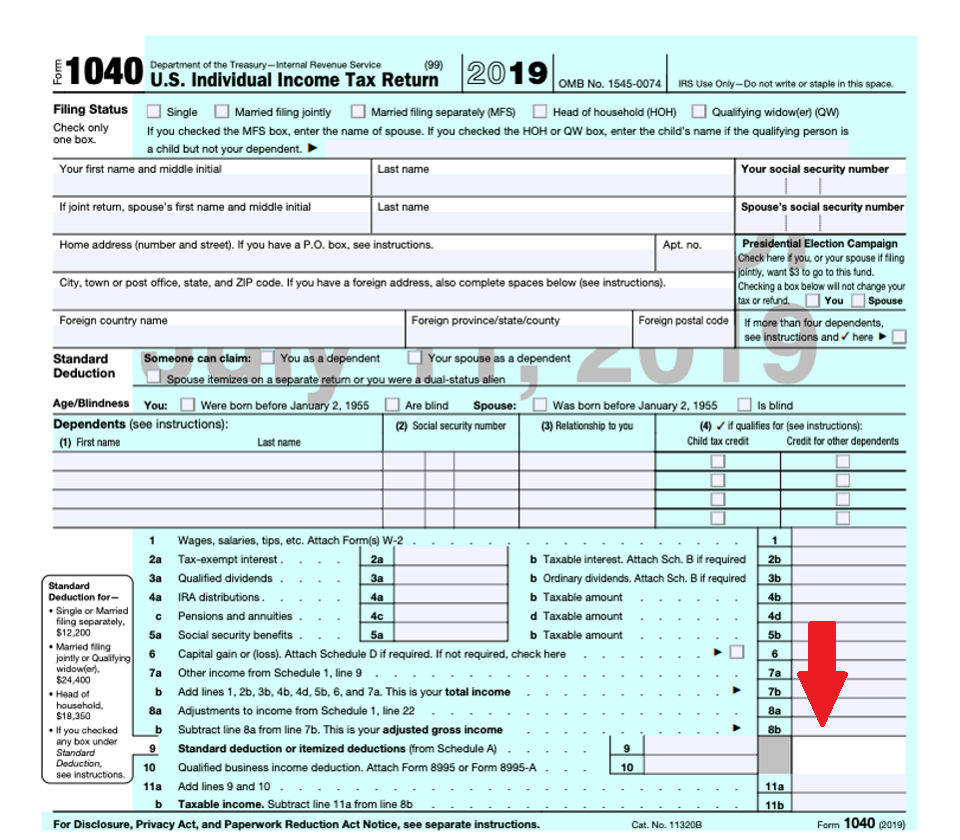

It’s probably been a while since you definitely took that course in taxation, so here’s where to find your AGI on your tax return.  The guv’ment is paying parents an additional $500/child that is UNDER 17. This does not include children that already are 17. As of when is not clear. But what is clear is that many younger adults/older teens won’t be getting checks, despite only having limited or zero income. Think about a college student, for example, that is still claimed as a dependent by a parent, but has their own bills to pay. The student won’t be getting a check and neither will their parents (on their behalf because they’re too old). Same scenario but with a disabled adult child. No check.

The guv’ment is paying parents an additional $500/child that is UNDER 17. This does not include children that already are 17. As of when is not clear. But what is clear is that many younger adults/older teens won’t be getting checks, despite only having limited or zero income. Think about a college student, for example, that is still claimed as a dependent by a parent, but has their own bills to pay. The student won’t be getting a check and neither will their parents (on their behalf because they’re too old). Same scenario but with a disabled adult child. No check.

No matter how someone files their tax return, they will lose $50 of stimulus money for each additional $1,000 they earned beyond the income thresholds (above) until their entire potential stimulus amount is gone. You can check to see how much you will receive using the calculator here.

So married parents (of children under 17) have a bigger starting point, in dollars, to work with before their stimulus checks are potentially zeroed out.

For example.

If you’re single with no kids and earned $80,000 in salary in 2018, your $1,200 benefit would be reduced by the $5,000 you earned over the threshold, bringing your actual stimulus check to $950.

Compare that to a married filing jointly (MFJ) couple with three kids under the age of 17. Their maximum potential benefit would be $2,400 + $500/kid, or a total of $3,900. Suppose they earned a combined $170,000. Their benefit would be reduced by the $20,000 in excess above the $150,000 threshold. They lose $50 for every $1,000 in earnings above the threshold, so their benefit would be reduced by $1,000, leaving them with a stimulus check of $2,900.

The moral of the story is children provide a bigger buffer between you and the earnings phaseout threshold, so if you had a baby in 2019 and haven’t filed your return yet, it probably makes sense to make that a priority. For those keeping score at home, you’ll phase out completely (without children) at $99,000 as a single person, $198,000 if you’re married filing jointly, and $136,500 if you’re filing as head of household. Each child you have that’s under 17 “protects” another $10,000 of income from the phaseout limits.

This money will be distributed to people based on their 2018 tax returns or 2019 returns for people that have already filed. I have not seen a clear cutoff date that has been published, and this brings about planning opportunities for many people based on several things. The checks will be direct deposited to folks that have their bank account information on file with the IRS, and mailed to those that don’t have their information on file. You don’t have to do anything to receive the money.

The tax filing deadline was moved back from 4/15 to 7/15. If you are expecting a refund, I would encourage you to file your return as soon as possible. But many folks that owe money have been justifiably waiting to file their return. However, it may make sense to hurry up and file their return if their 2019 income would justify a stimulus check but their 2018 return would not. So if your income dipped in 2019, it could make sense to re-evaluate your tax filing urgency.

The next opportunities or things to consider are for folks that had a life event. Did you get married, divorced, have a baby, or experience the death of a spouse or child in 2018 or 2019? It is possible the tax return the IRS has on file from 2018 does not accurately reflect your life circumstances almost two full years later. If you’ve experienced one of those life events I mentioned, you might want to revisit whether it makes sense to go ahead and file your taxes earlier than you planned to. If you’re ultimately eligible for the tax credit based on your actual 2020 tax return, you will receive it when you file your 2020 taxes in 2021, but that doesn’t do you much good now. And realistically, it looks like the checks won’t be directly deposited (if the IRS has your bank account on file) or mailed until May anyway.

This brings up another batch of folks that need to do some due diligence. Does the IRS have your accurate address and bank account on file? Look at your returns. You can file a form 8822 with the IRS to update your address without filing your tax return. Looking at you, folks that moved in 2018 (and haven’t filed 2019 yet) or 2019. You’ll want to be proactive about this because the government expects to resolve address discrepancies with…a phone number. Good luck getting through?

Money, It’s A Gas

The CARES Act significantly expanded access to folks’ retirement income if they need it. One might be able to argue, in a paternalistic way, that this shouldn’t have been done but it was.

You are now eligible to take a penalty-free withdrawal of up to $100,000 (combined) from your IRA or employer plan in 2020 as long as you, your spouse, or a dependent are diagnosed with COVID-19, you suffer financial consequences from being quarantined, furloughed, received less working hours, or were outright laid off, OR you were taking care of a child because of a lack of childcare, OR you own a business that closed or significantly reduced operations. I’m out of breath just typing that heinous run-on sentence.

The distributions are free of the normal 10% early withdrawal penalty, and there is no mandatory 20% withholding (customary on withdrawals from retirement plans), so you could potentially…grab that cash with both hands and make a stash.

Where this gets interesting is the ability to spread taxation over 3 years, or it can all be included in 2020. It is important to note that it is an either/or proposition. So if you DO (please only resort to your retirement funds as an absolute last resort) take a distribution, be strategic about how you’ll approach the taxes. Most people would probably benefit from spreading the taxation over 3 years. However, considering how 2020 is going, many people are going to have much lower income in 2020 anyway, so this could be the best year to include income in your taxable income. I recommend you try to utilize a combination of other savings, a home equity loan/line of credit, or a retirement plan loan before taking an outright distribution.

Retirement plans are also increasing the loans available to $100,000 (increased from $50,000). Hypothetically speaking, if you have an IRA and your employer’s plan will accept rollovers INTO the plan, you could potentially roll your IRA into your 401(k) at work and then ask for a loan from your now-increased vested account balance, up to a maximum of $100,000, if you didn’t want to take an outright distribution. This could save you from taking a distribution from your retirement account that would otherwise be taxable, and the interest on your 401(k) loan will be repaid to the first national bank of YOU. That’s right, 401(k) loans, though also not ideal, pay yourself interest. Not every plan has to offer loans but the CARES Act seems to address this, so some people might have access to $100,000 of borrowing ability (from their retirement plan) for the very first time! According to SHRM, if you already have a 401(k) loan that has a repayment due between 3/27/2020 and 12/31/2020, you can delay your loan repayments for up to a year.

But say you DO take a distribution and do not take a loan. If you resume your employment and are able to put your retirement plan distribution “back in the tube,” fortunately you have 3 years to do so starting the day after you receive your Coronavirus-Related Distribution. There is some flexibility to this option, and you could put the money back in multiple partial rollovers back into the play during that three-year period.

I think this is a good time to remind folks that if your employment is stable, try to keep making those contributions. Heck, you might consider increasing them too. The market is down significantly, making this a great opportunity for those 401(k)/403(b)/SIMPLE IRA contributions to buy more shares than they normally would.

Do Less

Normally, Uncle Sam allows folks to make pre-tax contributions to retirement accounts that are eventually taxable when they turn 72. The government encourages you to save through these valuable tax breaks. But, eventually, the government wants their income tax revenue they’ve postponed by giving you those tax breaks, and they force folks to take Required Minimum Distributions (RMD’s) from their pre-tax accounts to generate tax revenue once they turn 72.

The CARES Act allows those individuals that would normally be subject to an RMD to skip 2020. For people taking RMDs from their own account that might have already taken a distribution for 2020, you can roll the distribution back into the account if it’s within 60 days of the distribution, provided you haven’t done another rollover within the last 365 days. In a sense, the IRS is allowing you to “do less” by doing less than the minimum that would have been required. Next year, your RMD will still be based on your reduced life expectancy, so you won’t be able to just skip a year entirely. One interesting planning point is for folks that turned 70.5 in 2019 that would have been required to take their very first RMD by April 1st, 2020 and then their second RMD by 12/31/2020. In a stroke of good luck, they are now able to skip BOTH. This probably sounds better in theory than reality, as very few people don’t use their retirement accounts to live on. In fact, an Investment Company Institute research paper from 2018 called “The Role of IRAs in US Households’ Saving for Retirement, 2018” estimated about the overwhelming majority of retirees are already taking more than the Required Minimum Distribution anyway.

One potential planning strategy that could be employed is taking what would have been your RMD and characterize it, legitimately of course, as a Coronavirus-Related Distribution and spread out the taxation over 3 years. I suspect this is not something that will work out well for most retirees with limited incomes, to begin with, since they might be better off taking the distribution and paying lower taxes than adding income to subsequent years with their own respective RMD distributions. This does present a better opportunity for individuals with an Inherited IRA though. Barring individuals that use Inherited IRA’s to live on, the ideal strategy is to take the smallest legal amount of distributions possible. The CARES Act turns the light green to skip RMDs for Inherited IRA’s too unless you’ve already taken the distribution for the year. If that’s the case for you, there’s no way to put the RMD genie back in the bottle.

Another opportunity for folks that would normally have to take an RMD but don’t actually need the money. If so, you could make a Roth IRA conversion instead of your RMD since your income will be lower without the RMD to begin with. Thanks to the SECURE Act, your beneficiaries will only have 10 years to liquidate any pre-tax accounts you leave them, so they could very well be inheriting your pre-tax retirement account in their own peak earning years and pay more tax than you would have if you did a Roth IRA conversion and took care of the tax bill for them.

Do More

The Tax Cuts and Jobs Act of 2017 made itemizing deductions moot for about 90% of tax filers and effectively squashed the tax benefit of charitable donations as people pivoted to taking the standard deduction instead.

The CARES Act adds a new, apparently permanent $300 above-the-line deduction for charitable contributions. Which is nice..but again…not very useful. Even the folks in the highest of tax brackets (37%) will only receive $111 of benefit from the tax savings. But it’s still something. There are a lot of good causes to donate to right now, and this restores some of the tax benefit of helping others with charitable contributions.

There’s also a temporary increase in the limit of cash contributions that can be made to offset taxable income from 60% to 100% for 2020. So that means you can donate enough cash to completely zero out your tax liability for 2020. Which again, is probably better in theory than in practice because so many people are going to already have lower income in 2020 because of COVID-19 anyway. If you “over donate,” any excess contributions can be carried forward for up to five years to be used as future charitable contributions to be used as the new $300 deduction or if you’ll be itemizing.

Ball And Chain

Payments will be automatically suspended on federally (Department of Education) held loans until 9/30/2020. Even though the CARES Act was signed into law on 3/27/2020, you can actually ask for a refund on your student loan payments if you made a payment on or after 3/13/2020 if they contact their lender! Unfortunately, private loans, Perkins loans owned by colleges, and privately held FFEL Loans will need to be repaid, so you should check with your lender about any loan modifications they’re offering because they’re not eligible for stimulus relief. If you’re not sure what kind of loans you have, start by going to www.StudentAid.gov, create an account, and see which loans are held by the Department of Education.

For Direct loans, you don’t have to do anything to stop the payments. But my question to you would be…should you stop payments? You’re certainly welcome to make voluntary payments during this time, which by the way won’t be accruing interest. So imagine having the full extent of your payment be applied against your loan. Keep making those payments if your income is stable. UNLESS.

And this is a big unless. Unless you’re pursuing loan forgiveness. In an ideal world, you want to get the maximum amount of your loans forgiven. And these six months WILL count towards your 120 payment requirement for Public Service Loan Forgiveness (PSLF) even though you’re not actually making payments. So if you’re pursuing PSLF, I would highly recommend NOT making payments until after 9/30/2020. Some of the student loan servicer websites have reportedly been saying payments are still due to qualify for forgiveness. Once again, we can probably chalk this up to the servicers trying to get a handle on the full meaning of the CARES Act.

The only exception…to my exception…is if you’re NOT going after PSLF and you do have some other lingering high-interest debt. Suppose you have some credit card debt or a personal loan that’s still outstanding. This could be a good six-month opportunity, again if you have FEDERAL loans, to not make any payments and use the money you would have used to beat those other, likely more expensive debts down. Or you could use the payment holiday to bank the savings in your emergency fund. Or you could bump up your contributions to your 529 plan.

The CARES Act also expands the role employers can play to help employees with student loan debt in 2020. Previously, employers could give employees up to $5,250 to pursue additional education without including it in their income. For 2020, the CARES Act allows employers to provide $5,250 of benefit for EXISTING loans without including it in the employee’s taxable income. The $5,250 overall limit still exists, and this is not available in plans that discriminate to highly-compensated employees.

If you think you might fall behind on your payments, it might be a good idea to bank the savings from the student loan payments you would have made and build up an emergency fund.

If your loans are already in default, the Department of Education has stopped the process of collecting federal loans, so you may have a temporary reprieve from wage garnishment, tax refund, and Social Security withholding. Talk to your loan servicer if you need help with any other loans you have.

Turns out, there’s something for parents in here too. If you’re a parent with PLUS loans, the payment holiday also applies to you too.

Read more about student loan relief here.

Unemployment Compensation

Arguably the biggest benefit of the CARES Act is the expansion of unemployment benefits. People are out of work and the bills don’t care. Jobless claims soared last week as folks are adjusting to the reality of reduced or eliminated opportunities to work, and the government needed to address that.

Unemployment Compensation (UC) varies state to state, but Pennsylvania residents traditionally are eligible for 26 weeks of benefits after a one-week waiting period. The CARES Act makes several changes to eligibility, timing, and amounts of benefits.

First, folks that would not usually qualify for unemployment are covered. This is a huge win for the self-employed, gig workers, freelancers, and independent contractors. Furloughed employees are also eligible, so it is possible employees could still have company benefits but no paychecks from their employer. One important note here is that folks that don’t have the work history or pay documentation to file for unemployment are still waiting for additional guidance from the Labor Department. Consider a scenario for recent college graduates that may not have a work/tax history, don’t have a pay stub, etc. Those folks seem to be neglected in this for now. Check back for updates.

Normally, you’d have to register for PACareerLink.pa.gov and prove you are looking for work. These requirements have been lifted to get money to people faster and more efficiently.

The normal one-week waiting period (in PA) has been eliminated. If your income, hours, or job have been changed, I strongly encourage you to review the eligibility details and file an application ASAP. Pennsylvania employs 183 claims examiners and 109 intake interviewers. From 3/15-3/30, those poor folks have received 890,964 applications for UC. For some depressing context, 3/15 was the only day during that two and a half week timeframe that had less than 35,000 applications in a single day. So right now, those folks working in the Office of Unemployment Compensation are VERY busy. The state’s website says flat out that they don’t have time to answer general inquiries and I quote, “Don’t call or ask about eligibility, just file.” Phone lines are jammed and the chat is overwhelmed. The application keeps crashing. If you think you even might be eligible for UC, get started on your application as soon as possible. You should file your first claim in the week your hours are actually reduced or eliminated.

Pennsylvania’s website says they’re mailing PIN numbers out as fast as they possibly can and that applicants should expect them to arrive within 2-4 weeks. It does appear that it’s possible to file without the PIN. So keep filing even if you’re still waiting for approval. If you’re eventually approved, you’ll receive retroactive benefits. Your best bet right now is to probably set your alarm for 3am and try to complete the application online during off hours. Or you could mail in a paper application, although I confess I do not know how they are prioritizing online vs. paper applications at this time.

The traditional state-level UC benefits should replace approximately 50-70% of your reported pre-tax earnings (you’d have to have declared tips, for example, to have them replaced), with an additional maximum benefit for spousal and dependent benefit of….wait for it….$8/week. I dare you to go tell your spouse and children they’re only worth $8 a week right now!

It is important to point out that UC is only taxable at the Federal level. You can elect to have 10% withheld for taxes so it is important to make a determination for your household whether you need the full benefit and will worry about the tax bill later, or whether you just want to do SOME withholding now to get it out of the way for your 2020 tax filing next year. All that said, the CARES Act also greatly increases the benefits for unemployed people by $600/week for a maximum of four months. Regular unemployment benefits will be paid for an additional 13 weeks too. So if you are receiving UC, it is important to keep in mind your benefit, unless changed again, will go down after 7/30/2020, to your traditional benefit amount, and will completely stop after another 13 weeks. PA has some great tutorials available here and here for first-time filers that I would highly recommend going through before your filing.

Benefits are limited to US citizens, lawful residents of the US, or individuals that have work authorization in the US.

Leave

Technically, the expanded family leave benefits are under the Families First Coronavirus Response Act (FFCRA), but you’re already here so let’s keep this party going!

The FFCRA says employees of covered employers are eligible, STARTING 4/1/2020 (no retroactive leave) for:

2 weeks (up to 80 hours) of paid leave at their normal level of pay if the employee is quarantined, experiencing COVID-19 symptoms AND seeking a medical diagnosis, OR

2 weeks (again, up to 80 hours) of paid leave at ⅔ their normal level of pay if the employee can’t work because they’re taking care of someone that is quarantined, a child that isn’t in school because of COVID-19, or the employee is experiencing a similar condition as specified by Secretary of Health and Human Services, in consultation with the Secretaries of Treasury and Labor. Remember those bits of additional guidance I referenced when we got started? This is one of those “wait and see” pieces I was talking about.

Finally, the FFCRA provides for up to an additional 10 weeks of paid expanded family and medical leave at ⅔ the employee’s normal level of pay if the employee is still taking care of a child at home that can’t go to school because the school is closed because of COVID-19, provided the employee has been employed for at least 30 calendar days. However, workers that were laid off after 3/1/2020 but rehired by the same employer are eligible for paid leave, as long as they were employed 30 of the last 60 days BEFORE they were laid off. Your leave does not need to be consecutive days off, if that helps you/your employer. Pay is based on your regular rate of pay, so for the folks that have variable income, this will be based on your average weekly pay over the past six months (if you’ve been there that long), or however long you’ve been employed.

So to be clear, full-time employees get 12 full weeks of paid leave. Part-time employees receive leave for the number of hours they normally work over that period.

To make matters more complicated, employers with under 50 employees can be exempt from the requirement to provide paid leave if it would sink the business, and employees and employers with more than 500 employees don’t qualify. Most employees of the federal government are also excluded from additional paid leave. Clear as mud, right?

Philadelphia has its own sick leave law that can be used to cover time off due to a quarantine, business closure, or caring for a child because their school is closed. Employees of employers with more than nine employees can accrue up to five days of paid sick leave. Employees of employers with fewer than nine employees can accrue up to five days of unpaid sick leave. The time off can be used if you’re sick or your child is sick. Workers accrue one hour of leave per 40 hours worked, earning a maximum of 40 hours of paid leave per year and you have to have worked there 90 days before you can use ‘em.

There are a myriad of other rules or exceptions for union employees, employees of chains with more than 14 global locations.

Roof Over Your Head

If you know you’re going to have trouble paying your mortgage, it is important to talk to your loan servicer (who you send payments to). This goes for any kind of debt you have, but particularly with mortgages. Fannie Mae and Freddie Mac have come out and offered additional COVID-19 related relief options. In particular, both Fannie Mae and Freddie Mac say they’ve stopped foreclosure sales and evictions for 60 days, and homeowners can request a forbearance for up to 12 months. That’s good news because together, they own about half of the country’s mortgages. On top of that, they’re also suspending late fees and credit bureau reporting for borrowers in a forbearance related to COVID-19. The head of the Federal Housing Finance Agency (FHFA) is literally begging people to only use this if they’ve actually lost their job and can’t pay their mortgage. There’s no proof of burden yet, so borrowers could fudge their hardship for now. But eventually, they’d have to set up a payment plan which will require documentation. Make sure you understand exactly what happens to your loan after the forbearance. Will it be a balloon payment at the end? Will you need to make catch-up payments? Will your regular monthly payments go up? Will the loan be extended? There are websites available to see if Fannie Mae or Freddie Mac own the loan for the house you own or rent.

Rent is tougher to navigate. Talk to your landlord and see if you can work something out. The absolute worst thing you could do is hide. If you think you won’t be able to make rent, get in touch with them as early as possible. If the house you rent has a federally backed mortgage, you can’t be evicted for 120 days thanks to the CARES Act. I would recommend you pay a visit to the Fannie Mae and Freddie Mac websites above to find out

Check back here for updates for homeowners and renters.

Healthcare

Employees that lose their jobs and their healthcare through their jobs may have the option of keeping their existing coverage for 18 months thanks to the Consolidated Omnibus Budget Reconciliation Act (better known as COBRA). To be frank, this is going to be a bad option for most people. COBRA coverage is expensive, but if you’re dab smack in the middle of treatment for something, it could facilitate the process of keeping your same doctors.

Realistically, you should consider obtaining a policy through the Affordable Care Act, especially if you’re a dual-income household that will still have some income. Go to Healthcare.gov and follow the prompts for your state. Pennsylvania’s transition to their own exchange website seems to be functioning, with the added benefit of being able to screen yourself for eligibility for CHIP (health insurance for children), Medicaid, Mental Health/Substance Abuse, and the Health Insurance Marketplace (previously available on Healthcare.gov). There’s also the ability to add Cash Assistance (Temporary Assistance for Needy Families for pregnant women, dependent children and their parents who live with them, and dependent children and other relatives who live with them and care for them), SNAP (food stamps), and Low-Income Home Energy Assistance. So, a lot all in one-stop-shopping via the Compass site but you should also be able to access PA’s Affordable Care Act application via Healthcare.gov.

For my other MidAtlantic friends, Delaware and New Jersey’s Affordable Care Act application are still on Healthcare.gov.

New York’s application can be found here. Maryland’s application can be found here. Maryland and New York are both offering a special enrollment period through April 15 because of Coronavirus.

If you’re already purchasing your health insurance through the Affordable Care Act and now you’re making less money, you should absolutely go back to Healthcare.gov and update your income to adjust your expected income to potentially offset a greater amount of the insurance premiums through a larger advanced tax credit.

Finally

One additional benefit of the CARES Act was its expansion of the rules for HSA’s. Folks with high-deductible insurance plans can utilize telehealth services before they’ve hit their plan deductible until 12/31/2020. Far more notable though was the addition of qualified distributions from HSA, HRA, and FSA accounts for menstrual products. This is a permanent change. Stepping back a minute, it literally took the world coming to a screeching halt for the government to say “ya know what, we’ll give these ladies a tax break on their periods.”

I think this is a great step forward for women, but I’d prefer you still keep the money in your HSA and pay for expenses out of pocket as I’ve written about before.

Many of these are fluid programs with new details and additional clarifications coming out as the various governments figure out how to actually get these services to people. Please keep checking back here for updates and most importantly, how to apply them to your personal situation. We’ve experienced an incredible amount of volatility in the market (read more about that here). There are a lot of pieces to this that could be applicable to you and there are planning strategies that can be used by a lot of people. If it feels like a byzantine maze of new rules and opportunities, it is. I can’t tell you how many times I was ready to hit “publish” and then would see something new posted about the IRS now says this and blah blah. There are a lot of hands, and they’re only just now starting to talk to each other. It’s important to work with your tax advisor and fee-only financial professional to work through what’s relevant to you. I offer a complimentary 60-minute consultation so book your free call on my website (here) to chat about what’s going on with you and how I can help you. I was early to the video chat game and have always offered virtual meetings, so it’s largely been business as usual here. As always, if you think this could be valuable for people that need help, feel free to pass it along.

Stay safe out there!

Brendan